While I remain primarily a short seller, I also buy pump & dumps sometimes. However, I usually only hold for short periods of time — minutes or hours. While the vast majority of traders of penny stocks lose money (and most of that money is made by the stock promoters themselves, and a small bit goes to short sellers), sometimes buying penny stocks can be lucrative — but only if you are quick and know what you are doing. The chance of outsized gains, no matter how small, leads to a sizeable group of traders who try to make money by buying stock promotions. So while a large stock promotion budget tells me that there are holders of a huge number of shares who want to sell, traders who look to buy stock promotions will see a large budget (not incorrectly) as a sign that more people will receive the stock promotion and buy, sending the price up. Most pump and dumps never go up much, if at all, but that doesn’t keep people from buying them.

Of course, if you are a small shareholder of a penny stock company and want to get the share price to go up, but can’t afford to pay for a stock promotion, what you could do is just put together a fake promotion and then post it on Twitter and internet message boards like iHub (InvestorsHub, the cesspool of the internet). If you convince enough people that the pump is real, you could get the price of your stock to move up. Of course, the SEC might come knocking on your door if you are successful, accusing you of market manipulation.

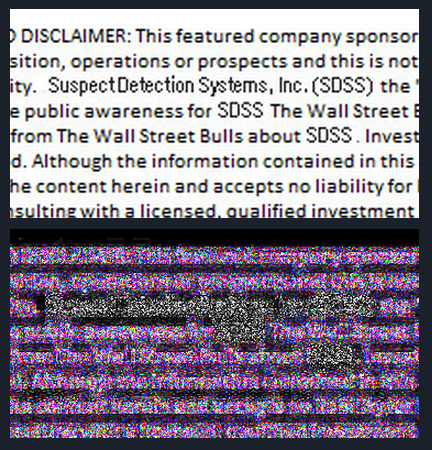

I came across this post on iHub earlier today and was amused by how badly faked the ‘hard mailer’ was. (For those who don’t know, that is the common term for pump and dump brochures sent through postal mail rather than email). I looked at the image and it was obvious that rather than even printing out and then scanning the faked mailer, the person had simply used image editing software to paste in new text over a scan of a different mailer. See the full image. While the image was obviously faked (notice the lack of any sort of smudge except in a areas where there is no text; also note the different font used for the company name and ticker in the disclaimer at the bottom), I thought it would make for a nice test of image error level analysis.

Here is what that shows us on a small section of the disclaimer (see original at the FotoForensics website):

What this analysis essentially does is it degrades the image down to show just the digital noise. In an unedited image the noise will be random (you will be able to notice original shapes in the image but around those shapes there should be just random noise). An image that combines two images of different quality levels will allow us to see where the two images are combined. Many common editing techniques such as smoothing/blurring will also be quite obvious through this analysis. The above image shows that the company’s name and ticker came from another image with less noise — and most likely were from an undegraded image (i.e., they were created in the image editing program).

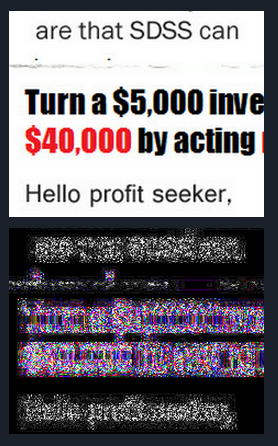

Above is another example taken from the fake mailer (see it on the FotoForensic website). The paper crease shows a decent amount of error, as does the two lines just below it, but there is much less error around the other text, including the ticker symbol.

In this case, I didn’t need image error level analysis to tell that the image was manipulated. But it is a powerful tool that can help identify manipulation even in better fakes.

Disclaimer: I have no position in any stocks mentioned. I trade pump and dumps and OTCBB / Pinksheets stocks. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.

Great post Miohael.

Mike, how do you decide when a p&d is worth jumping in on? I mean, there are soooo many 10 to 15 minute wonders! Market opens at 9:30, the pump gaps up, you’re chasing it up, you finally catch it 5 minutes into the open, then BOOM, the dump, and you bought in at the high. 9:45am you’re smacking your monitor around screaming all kinds of 4 letter words! (don’t ask me how I know, please).

So how do you know that a pump might be sustainable for a few days?

Gary

99% of pumpers I would never consider buying their pumps. All you do is track a few of a website’s pumps and see how they do. If at least three of four pumps did not close the first day of the pump significantly higher than the open or the start of the pump, then you should never, ever consider buying pumps from them again. Then build a list of pumpers that seem to do well and watch them over a longer time period. Crappy pumps are good for just one thing: shorting. I’ll short those on day one, many times even though they are not up.