Last week (the week of July 1st, 2019) was my first real ‘don’t even bother to look at your laptop to check stock prices during market hours’ vacation in two years. I took an Alaskan cruise and enjoyed seeing the sights (if you are ever in Ketchikan, Alaska, make sure to go snorkeling with Snorkel Alaska). So naturally the SEC decided that would be a good time to hand out more trading suspensions of active and recent pump and dumps in one week than it had done in years.

First, make sure to take a look at the article on the suspension by my friends at OTC Market Research: SEC Targets Boiler Room promoter. I will not repeat what they wrote (read it yourself!) except to list the stocks:

Anvia Holdings Corp (ANVV) was suspended on 2019-6-27 (PR | order)

Natural Health Farm Holdings (NHEL) was suspended on 2019-6-28 (PR | order). I wrote about the boiler-room pump & dump of NHEL on March 18, 2019.

Korver Corp (KOVR) was suspended on 2019-6-28 (PR | order)

Apotheca Biosciences Inc (CBDC) was suspended on 2019-6-28 (PR | order)

Befut Global (BFTI) was suspended on 2019-6-28 (PR | order)

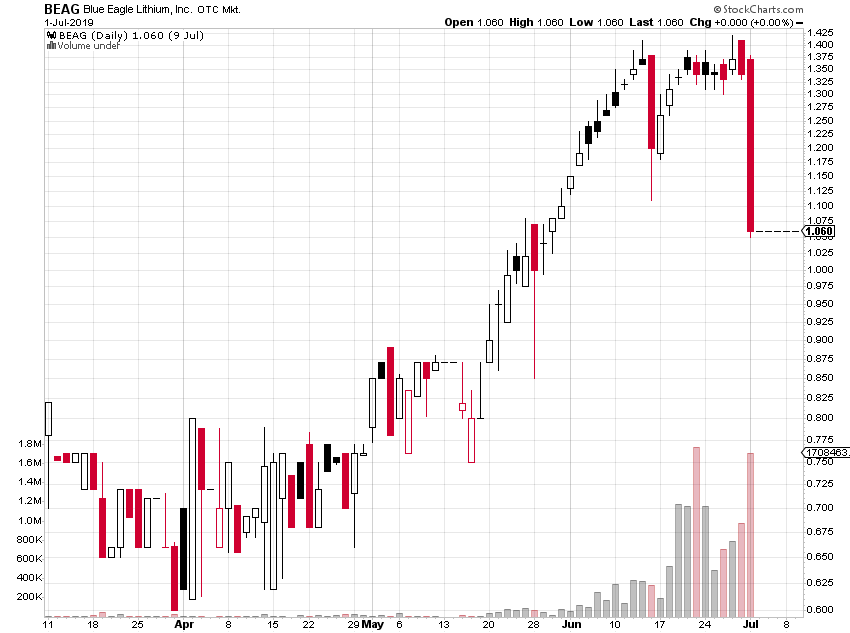

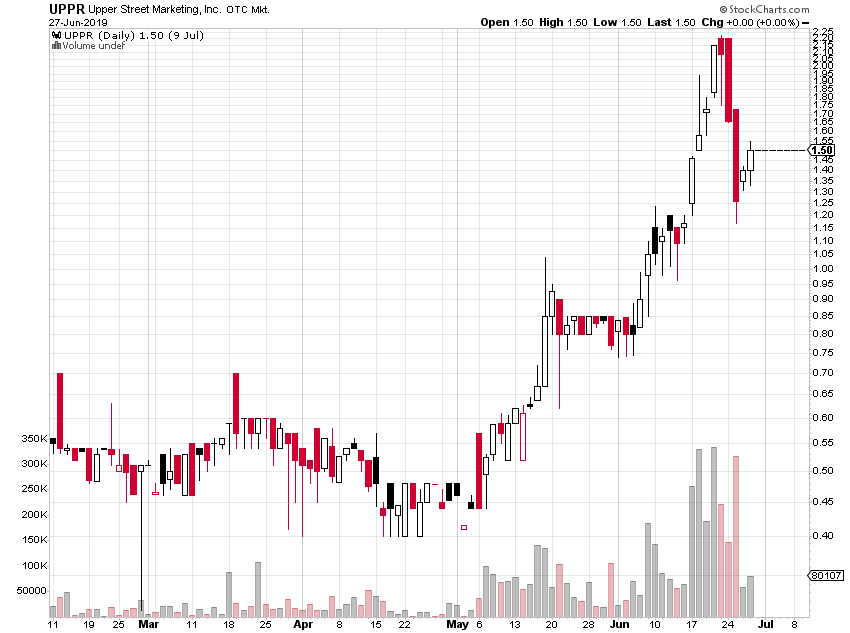

Besides the above companies that were written about at OTC Market Research, the SEC also suspended trading in two stocks that are not connected with the others: Blue Eagle Lithium (BEAG) was suspended on July 1, 2019 and Upper Street Marketing Inc (UPPR) was suspended on June 27, 2019.

I previously wrote about the mailer promotion of BEAG on June 25, 2019. Read the SEC press release (pdf) and suspension order (pdf). BEAG will resume trading at the open on July 17, 2019. The reason given for the suspension (from the PR):

questions regarding (i) the accuracy and adequacy of publicly available information in the marketplace, since at least May 22, 2019, about the company, including statements in online promotional materials regarding analyst findings and the extent of the company’s mining claims; and (ii) recent unusual unexplained market activity in Blue Eagle Lithium, Inc.’s common stock.

Trading in Upper Street Marketing Inc. (UPPR) was suspended by the SEC on June 27, 2019. The stock will resume trading at the open on July 15, 2019. See the SEC press release (pdf) and the suspension order (pdf). The reasons given for the trading suspension are (surprisingly) quite specific:

questions about the accuracy and adequacy of information publicly disseminated concerning UPPR, including, among other things: (1) public statements by UPPR dated May 8, 2019 and May 23, 2019 concerning $10.55 million worth of purported financing for UPPR; (2) public statements by UPPR dated April 30, 2019 and May 23, 2019 denying its retention of an investor relations firm despite apparent possible promotional activity on behalf of UPPR; and (3) inadequate statements, since at least November 2018, concerning a possible private offering of at least $3 million dollars in UPPR’s common stock.

Oddly, I found no PRs or other public statements from the company on the dates listed in the SEC suspension release or even with the specific topics mentioned in the SEC release. I searched OTCMarkets.com, GlobeNewswire, and http://upperstreetmarketing.com, https://twitter.com/Growing_Springs, and https://www.facebook.com/GrowingSprings.

Disclaimer: I have no position in any stock mentioned. I have no relationship with any parties mentioned above except that I am a paying subscriber to OTC Market Research. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.

One thought on “SEC Brings the Suspensions to many pump & dumps the one week I’m on vacation”