Disclosure: I am short NHEL. Even if I weren’t short, I would still advise against the stock. I am actively looking to increase my short position.

I have traded hundreds if not thousands of pump and dumps and blogged about many of them here over the last 12 years. While big email pumps and snail mail pumps are far rarer than they were 5 years ago, the pace of boiler-room pumps does not seem to me to have decreased. See my blog posts on recent boiler room pumps from October 2018, June 2018, and November 2017.

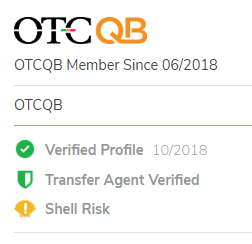

Today’s boiler-room stock promotion is Natural Health Farm Holdings (NHEL). I will only briefly touch on the fundamentals of the company, which are as usual absurd. Read the company’s SEC filings. The company has total assets valued at only $125,337 (per the most recent 10-Q). See NHEL’s company profile on OTCMarkets. A brief aside — I am sincerely impressed with the accumulation of small changes that OTCMarkets has made to their platform to bring transparency to the market. One nice feature is displaying share counts verified by the transfer agent — in the case of NHEL it is 161,859,500 shares as of 2/25/2019. With the stock at $1.25 as I write this, that gives the company a whopping $200 million market capitalization. Also, the company reports in its OTCQB certification (pdf) filed on 1/2/2019 that there are 30 million shares in the public float (some or all of these shares are being sold in the pump and dump). Another useful bit of info provided by OTCMarkets now is the shell risk disclosure displayed for NHEL. According to OTCMarkets:

The Shell Risk designation indicates that a company displays characteristics common to Shell Companies. This designation is made at OTC Markets’ sole and absolute discretion based on an analysis of the company’s annual financial data and may differ from issuers’ self-reported shell classifications in their own public filings.

One benefit for the stock promoters / insiders in a boiler-room pump and dump is that information about the pump is not easily available: there is no paper trail of promotions. A side effect of this is that OTCMarkets seems to me to be slower to mark a stock promoted by

a boiler-room as undergoing stock promotion (NHEL currently lacks that flag) or ‘caveat emptor’ (NHEL also lacks that flag). That being said, once OTCMarkets becomes aware of a boiler-room pump I believe they are more likely to give it the ‘caveat emptor’ tag than they would be to give a stock undergoing email promotion a ‘caveat emptor’ tag. In the past, boiler-room pumps have dumped right after receiving the caveat emptor tag. For example, OLMM was given the ‘caveat emptor’ tag on march 8, 2018 and the next day it gapped down from $1.34 to $1.19 and ended that day at about $0.4103. Comerton Corp (COCM) received the ‘caveat emptor’ designation from OTCMarkets on June 5th, 2018. The next day it gapped down from $0.97 to $0.91 and closed at $0.83. Two days later it closed at $0.31.

With an average daily volume of over 300,000 shares over the month NHEL has already done better than most boiler-room pumps.

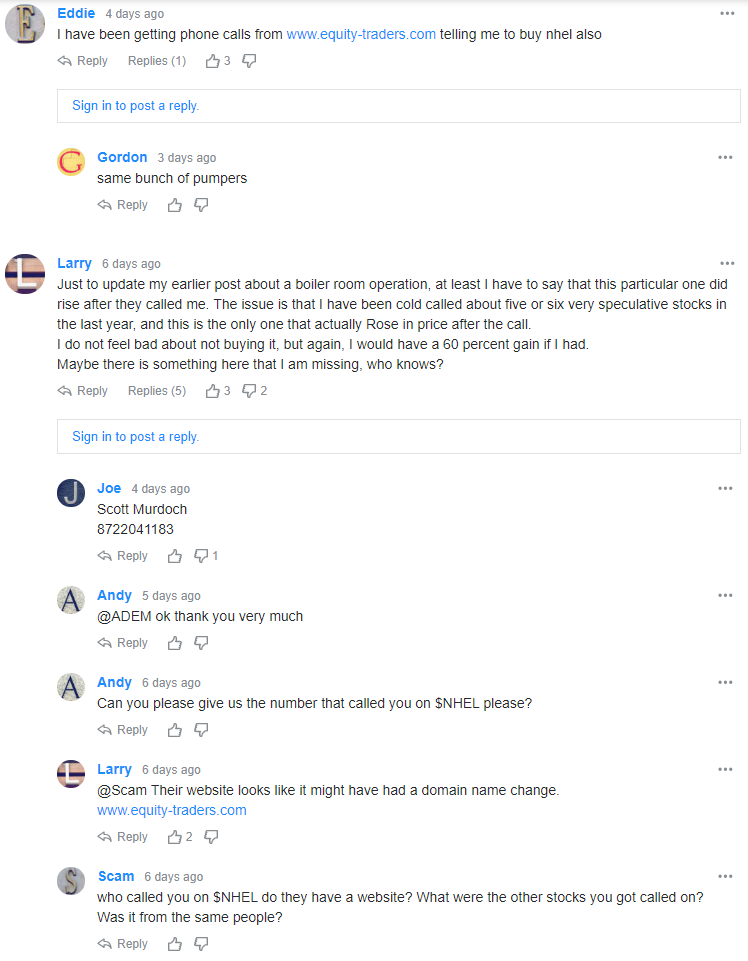

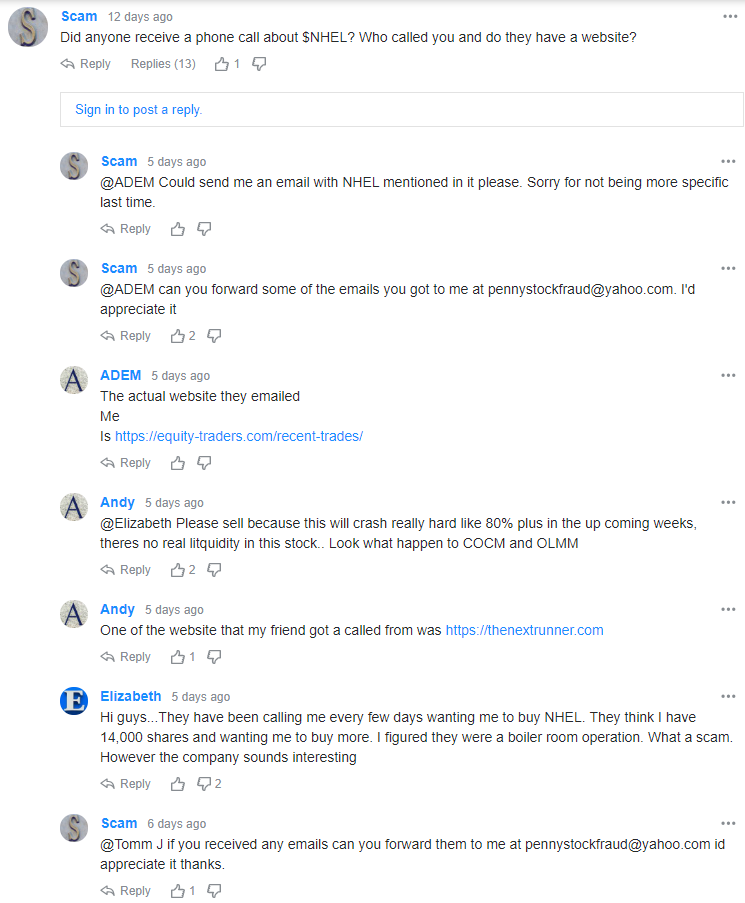

Reports of the boiler-room pump of NHEL can be found on Twitter and on stock message boards such as Yahoo and InvestorsHub. See screenshots below:

Besides the ongoing boiler-room pump & dump, NHEL has more fun awaiting investors: a toxic financing deal with GHS Investment LLC (see S-1 registration statement for details). GHS will get shares for a nice 20% discount to the “lowest traded price of the Company Common Stock during the ten (10) consecutive trading days prior to the date the Drawdown Notice was submitted” (quote from S-1). Of course by the time the company can start to make use of this financing arrangement the stock will likely be 90% below where it currently trades.

Disclaimer: I am short Natural Health Farm Holdings (NHEL) and am trying to borrow more shares to short. I may trade around this position (cover and reshort) at any time and will not update this blog post as I do so. I have no positions in other stocks mentioned in this blog post. I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.

“Like, Michael Goode has webinars about this for the trading-challenged students, where he changed his Gmail settings, and he could get the pumps earlier than other people. And so him and Tim Grittani both made a lot of money just buying pumps when they were being pumped very early on, and you could ride the pumps.” – Tim’s blog. It’s true?

Yep. Of course it is moot now because there are essentially no effective email promoters.

Anyway, did you try to find a way to predict promoter’s future actions in your trading career?

On March 19th OTCMarkets gave NHEL the ‘stock promotion’ warning/flag. I remain short.

Stock promotion flag now gone from OTCMarkets NHEL page: https://www.otcmarkets.com/stock/NHEL/overview

I remain short fwiw.

Still trying to find a broker to short with? Is this obvious (am I missing something?) or is that the secret sauce? Any information you can provide so I can try put a couple of ideas would be most helpful. Thank you. JB

NHEL is a change of strategy to save time and not be detected in OTCmarket, the purpose is the same pump and dump in a short time, it’s one more account of the group that operated several more, continues Instagram tactical_ttsi