The story of MintBroker International buying up large stakes in microcap companies and quickly selling them continues. I previously wrote about MintBroker filings SEC forms 3 and 4 reporting large stakes in New Concept Energy (GBR), MER Telemanagement Solutions (MTSL), and Avalon Holdings Corp (AWX). In that post I speculated on the potential profit MintBroker might have made on those trades using the average prices for share sales and guesses on the average prices on the buys. My conservative estimate for the AWX trades was a loss of $963,037 for MintBroker. However, MintBroker filed a new SEC form SC 13D last night listing all the trades in AWX from July 24th to August 1st, 2018. The trades are in an attachment to the form SC 13D.

I copied and pasted the table of AWX trades by MintBroker into a Google Sheets spreadsheet that anyone can view (only I can edit it). Please do check out the spreadsheet and see if I have made any errors. I counted a total of 2,680,759 shares of AWX bought and 2,686,047 shares sold over that period, which leaves 5,288 more shares sold than bought. This is possibly an error on my part or MintBroker’s part or possibly they bought those shares prior to July 24th. Regardless of the reason for the missing 5,288 shares, they don’t substantially change the calculation of MintBroker’s profit on the trades. As you can see in the spreadsheet I calculated that the average price of shares bought was $4.10 while the average price of shares sold was $6.41. Using the number of shares bought I calculated a total profit (after trading fees reported by MintBroker) of $6,202,596.22 (with uncertainty of about $20,000 based on the 5,288 missing shares). Needless to say my estimate of profits was way off and I likely badly underestimated MintBroker’s profits on the GBR and MTSL trades as well.

One trader I know of plotted all the buys and sells in Tradervue charting / trade analysis software. I have not verified his analysis but it is worth looking at:

🔎 I formatted and imported the $AWX Mint Broker trades to TraderVue. Here’s what it looks like cc/ re: @shaneblackmon‘s tweet. https://t.co/SSmuukUtFbhttps://t.co/Ks8jPP6LIN pic.twitter.com/zHI1rugiVO

— Del the Trader 📉 (@DeltheTrader) August 23, 2018

What’s crazy to me is the swings in the trade P&L. pic.twitter.com/bguztexLgB

— Del the Trader 📉 (@DeltheTrader) August 23, 2018

Besides calculating the profit, I was also able to easily calculate the number of shares held by MintBroker at the end of each day (by just adding up the shares in all the trades for each day). They are as follows:

July 24: 549,252

July 25: 1,142,961

July 26: 1,593,674

July 27: 1,721,628

July 30: 998,954

July 31: 197,354

August 1: -5,288

As you can no doubt tell by the negative position at the end of August 1st, my calculated MintBroker position at the end of each day is off by up to 5,288 shares.

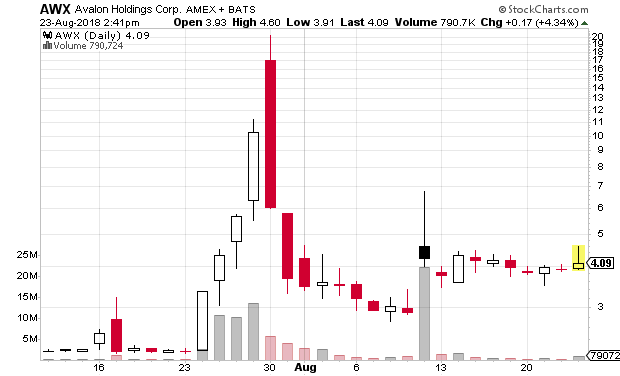

Below is a daily chart of Avalon’s stock price:

As of August 3rd (per the company’s August 9th Form 10-Q) Avalon Holdings “had 3,191,100 shares of its Class A Common Stock and 612,231 shares of its Class B Common Stock outstanding.” On July 27th, 2018 at 5:47pm MintBroker filed an SEC Form 3 showing direct ownership of 1,922,095 shares with the “date of event requiring statement” being 7/27/2018. But by my calculations based on MintBroker’s own data filed in the form SC 13D yesterday they owned over 10% of the shares of Avalon Holdings as early as July 24th.

I did not mention it in my prior blog post about Avalon Holdings and the other companies whose stock was traded by MintBroker, but there is an SEC rule called the “short swing profit rule“. Here is Investopedia’s definition:

The short-swing profit rule is a Securities & Exchange Commission regulation that requires company insiders to return any profits made from the purchase and sale of company stock if both transactions occur within a six-month period. A company insider, as determined by the rule, is any officer, director or holder of more than 10% of the company’s shares.

Securities lawyer Brenda Hamilton has a more detailed explanation (pdf). From Hamilton’s article:

Q. What remedies exist for Section 16 violations?

A. If an Insider violates Section 16, he or she must surrender their profits to the company.

How does the company obtain the profits from the insider? From Legal And Compliance LLC (pdf):

Any “profit,” whether inadvertent or intentional, realized by matching a purchase and sale within a six-month period is recoverable by the company. If the company fails to recover such profit, any shareholder of the company may sue to recover it on behalf of the company. Forms 3, 4 and 5 filed with the SEC are publicly available and are routinely monitored by attorneys who make their living by threatening to file Section 16(b) suits on behalf of shareholders. In the event of a violation of Section 16(b) by an insider, these attorneys are generally able to compel the company and/or the offending insider to pay their fees and expenses if the company had not acted to obtain restitution of the deemed “profit” from the insider prior to receiving a communication from the attorney.

On August 13th, Avalon Holdings filed suit against MintBroker International and Guy Gentile (its owner). Read this article from The Business Journal Daily for details and quotes from the CEO of Avalon. The lawsuit is Avalon Holdings Corporation v. Gentile (1:18-cv-07291) in U.S. District Court, Southern District of New York. CourtListener has the docket and the complaint (pdf) available for free. The lawsuit’s second claim is for short swing trading profits. According to the suit, “Profits are estimated to exceed $5,000,000.” The first claim in the lawsuit is for “Williams Act Compliance.” According to the complaint:

28. MINTBROKER and the other defendants have at no time to the present complied with their reporting obligations by filing a Schedule 13D and amendments thereto from the actual date of first entry into a more-than-5% beneficial ownership position to the date of their claimed liquidation of their position.

29. AVALON has no adequate remedy at law and invokes the equity powers of this court to enjoin MINTBROKER, GUY GENTILE and the other defendants to make such filings forthwith including in such filings complete and truthful responses to all questions including a detailed enumeration of purchases and deemed purchases and sales and deemed sales.

MintBroker and Guy Gentile have not yet filed an answer to the complaint.

Disclaimer: I have no position in any stock mentioned above. I have no relationship with any parties mentioned above except that one of the trading platforms I use is DAS Trader Pro and it may be partially owned by Guy Gentile (I am not sure). This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.

Thank you. That is really helpful.