Yesterday (July 2, 2018) the SEC filed suit against and then settled with “attorney T.J. Jesky and his law firm’s business affairs manager, Mark F. DeStefano,” for “violating the registration provisions of the federal securities laws” when they sold UBI Blockchain Internet (UBIA) stock. See the complaint (pdf).

The SEC had previously suspended trading (pdf) in UBIA from January 5th to January 23rd, 2018. The reason for the suspension at the time was:

(i) questions regarding the accuracy of assertions, since at least September 2017, by UBIA in filings with the Commission regarding the company’s business operations; and (ii) concerns about recent, unusual and unexplained market activity in the company’s Class A common stock since

at least November 2017

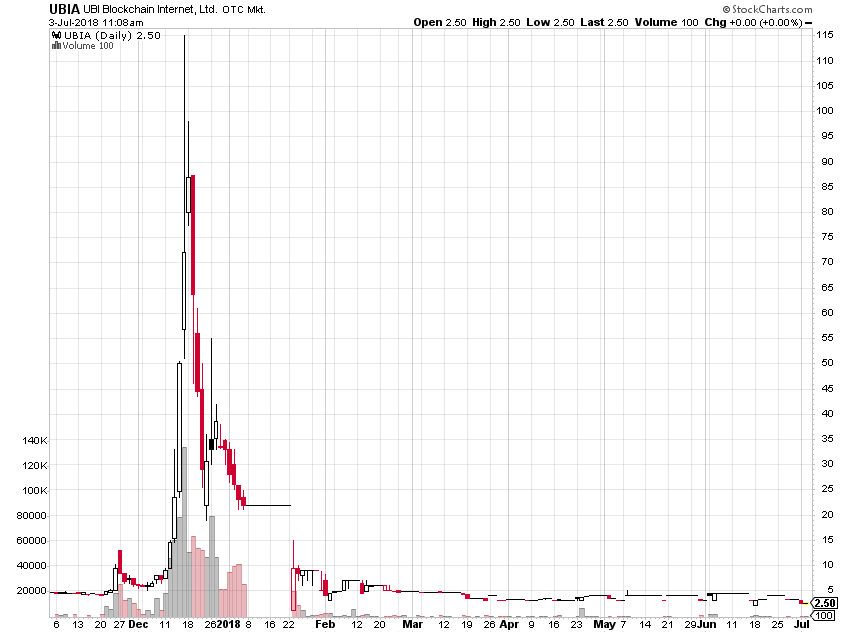

UBIA daily candlestick chart over last 8 months (click to enlarge):

Here are some details from the complaint:

1. This action seeks to enjoin further illegal conduct by, and obtain certain other relief from, Defendants Jesky and Destefano, who collectively illegally obtained approximately

$1.4 million in a ten-day period from their unlawful offers and sales of securities into the public market of UBI Blockchain Internet Ltd., which trades under the ticker symbol UBIA (“UBIA”). Even though the Defendants were required under the registration statement to sell their shares at a specific price that had been reported to the Commission and to the investing public, Defendants nonetheless sold their shares in the market for as much as thirteen times the required price.2. From about 2010 through 2016, UBIA was a shell company that claimed to be in the business of designing climate controlled units for the distributed production of energy. In

early 2017, however, UBIA announced that it had entered a new business, to engage in “the research and application of blockchain technology with a focus on the Internet of things covering food, drugs and healthcare.” The Defendants have been associated with UBIA since at least 2011.3. In October 2017, the Defendants arranged to receive UBIA shares in return for legal services rendered to UBIA by Jesky’s law firm, including the firm’s preparation of a

registration statement with the Commission. Pursuant to that registration statement, UBIA sought to register the public resale of certain shares, including the shares issued to Jesky and DeStefano. The registration statement prepared by the Jesky firm required that all Class A shares sold pursuant to the registration statement had to be sold at a fixed price of $3.70 per share.4. Inexplicably, UBIA’s stock experienced a dramatic increase after the Defendants acquired their shares, rising from approximately $4.00 per share on November 20, 2017 to a high of approximately $115.00 on December 15, 2017, even though UBIA had not issued any news releases that would have explained such an increase. As soon as the registration statement was declared effective on December 22,

2017, the Defendants began to unlawfully sell their shares at prices far in excess of the $3.70 price required by the registration statement. Between December 26, 2017 and January 5, 2018,Defendants sold more than 50,000 of their UBIA shares into the public over-the-counter market (“OTC”). Jesky sold 24,995 UBIA shares at prices between $21.12 and $48.13, for total proceeds of $766,036. DeStefano sold 26,000 UBIA shares at prices between $21.56 and $48.40, for total proceeds of $798,473.

6. The Defendants’ unlawful sales only stopped when the Commission suspended trading in UBIA stock on January 8, 2018, based on questions about the accuracy of assertions in

UBIA’s SEC filings and the recent, unusual market activity in the company’s stock.7. Defendants’ offers and sales of UBIA securities between December 26, 2017 and January 5, 2018, none of which were made at the fixed price of $3.70 required by the registration

statement filed with the Commission, were in violation of Sections 5(a) and (c) of the Securities Act of 1933 [15 U.S.C. § 77e(a) & (c)].

The settlement is a typical SEC settlement:

Without admitting or denying the allegations in the SEC’s complaint, Jesky and DeStefano agreed to return approximately $1.4 million of allegedly ill-gotten gains, pay $188,682 in penalties, and be subject to permanent injunctions. The settlement is subject to the court’s approval.

Disclaimer. No position in any stock mentioned and I have no relationship with anyone mentioned in this post. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.

The court has now approved the settlement so this matter is now over: https://www.sec.gov/litigation/litreleases/2018/lr24190.htm