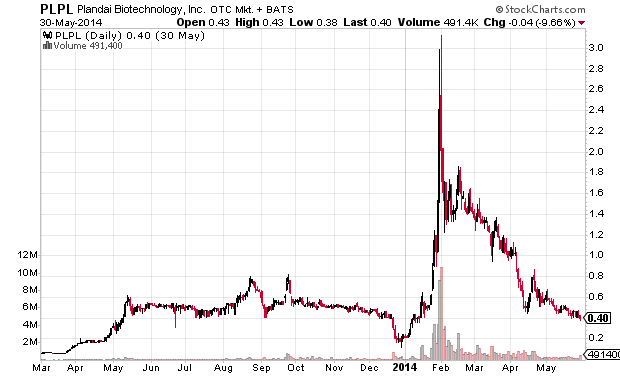

Plandai Biotechnology (PLPL) was a stock promotion that lasted for over a year from early 2013 through mid-2014. At the peak the stock went over $3 on volume of 10 million shares. On June 20th, 2018 the SEC filed suit against Joseph A. Fiore and two companies he allegedly controlled, Berkshire Capital Management Company, Inc. (“Berkshire”), and Eat at Joe’s, Ltd. (now known as SPYR, Inc., a public company that trades OTC as SPYR) (“Eat at Joe’s”).

Below is a chart of Plandai Biotechnology during the period in question.

See the SEC’s allegations in the following documents:

SEC Litigation Release

SEC complaint (pdf)

Case docket on CourtListener. The case is Securities and Exchange Commission v. Fiore (7:18-cv-05474) U.S. District Court, S.D. New York.

Excerpt from the complaint:

1. Defendant Fiore orchestrated a fraudulent scheme to promote and otherwise manipulate the market for the common stock of microcap company Plandai Biotechnology, Inc. (“Plandai”). Fiore engaged in a variety of deceptive conduct to affect the market for Plandai stock, while concealing that he controlled a large number of Plandai shares and intended to sell them. Fiore generated more than $11.5 million in illegal proceeds through his undisclosed sales of Plandai shares, through his own accounts and in accounts that he controlled in the names of Defendants Berkshire and Eat at Joe’s.

2. One facet of Fiore’s scheme was scalping, the illegal and deceptive practice of recommending that investors purchase a security while failing to disclose an intent to sell the same security. From at least April 2013 to March 2014 (the “Relevant Period”), Fiore, himself

and acting through his company Berkshire, organized, financed and directed a steady stream of stock alerts and research reports that promoted the purchase of Plandai stock. Fiore paid promoters directly to promote Plandai stock or, more commonly, paid third-party consultants to retain promoters to promote Plandai stock.

3. These promotions recommended that investors buy Plandai stock, while failing to disclose, as required by law, that Fiore, the organizer and funder of the promotional campaign, beneficially owned shares of Plandai stock, intended to sell shares, and was actively selling his

Plandai holdings into the public market. During the course of his scalping campaign, Fiore sold nearly 12 million shares of Plandai common stock through accounts he controlled.

4. Manipulative trading was another facet of Fiore’s fraudulent scheme. During the Relevant Period, Fiore, Berkshire, and Eat at Joe’s knowingly engaged in manipulative trading practices in order to induce investors to purchase Plandai stock, by artificially supporting and increasing the share price and creating the false appearance of market activity in the stock.

The complaint is quite detailed and gives details of Fiore’s alleged wash trading. According to the complaint:

During the Relevant Period, Fiore maintained and controlled six

brokerage accounts held in the name of Berkshire and six brokerage accounts held in the name of Eat at Joe’s. Fiore directed and controlled these accounts and used them, along with a brokerage account in his own name, to engage in the unlawful trading, as alleged herein.

The alleged stock promotions were not cheap:

24. Between April 2013 and March 2014, Fiore paid the promoters at least $2,137,000 to promote penny stocks, including Plandai, with approximately $675,000 going to the two intermediary consulting companies, who then retained third parties to promote Plandai

stock. Fiore personally selected the promoters, including the promoters that the consulting companies located and later retained on his behalf. He also paid the promoters for each promotional publication that they disseminated, and controlled the timing of their promotions.

One facet of promotions that I am familiar with is that they usually come at the same time as company press releases. And the alleged connection in the case of Plandai is quite explicit:

27. Throughout the promotional campaign, Fiore suggested topics for certain promotions and routinely provided the promoters with information about Plandai for use in their promotional materials. Fiore also frequently coordinated the dissemination of the promotional

materials to coincide with Plandai’s issuance of press releases, in order to generate additional positive news about Plandai.

28. On multiple occasions, Fiore received copies of Plandai press releases directly from Plandai before they had been publicly disseminated, and then forwarded the releases to third-party promoters for use in their promotional materials.

The SEC in its complaint also alleges the inadequacy of stock promoter disclaimers:

34. Fewer than half of the promotions contained generic disclaimers indicating that the promoter had been compensated for promoting the stock, and that Berkshire, or the unnamed entity paying for the promotions, “may own,” or “may sell” Plandai stock. But these disclaimers were incomplete, misleading, and materially inaccurate because Fiore and Berkshire were actively selling throughout the Relevant Period. Moreover, many promotions contained no such

disclaimer, and none of the promotions disclosed the true state of affairs: that Berkshire and Fiore beneficially owned, intended to sell and were actively selling shares of Plandai stock.

In addition to allegedly paying for promotion and liquidating stock, the SEC alleges that Fiore also at times supported the price of Plandai Biotechnology by buying stock:

54. Fiore first learned on or about June 25, 2013 that the Seattle Times was preparing an article suggesting that Plandai was a fraud. He began buying Plandai stock immediately thereafter for the purpose of manipulatively supporting the stock price and conditioning the

market in advance of the publication of the negative article.

55. On the eighteen trading days from June 25, 2013 to July 22, 2013, Fiore not only bought more Plandai shares than he sold, but his purchasing accounted for a significant portion of the market volume in Plandai stock. As discussed in paragraphs 63 to 77 below, Fiore’s purchases during this period were manipulative. Fiore’s trades set the closing price for Plandai stock on eleven of these eighteen trading days. On seven of those days, Fiore had also been responsible for the prior trade execution reported in the market, further indicating that his trades were an attempt to artificially inflate the stock price.

Who were the brokers?

The SEC complaint does not name the brokers and it is important to point out that Fiore is alleged to have lied to his brokers. The brokers have not been charged in the suit. For this reason, although I have identified “Broker B” with a high degree of certainty I will not identify the broker here. The complaint did not provide enough information for me to identify any of the other brokers allegedly used by Fiore or his companies.

Legal Threats against critic Alan Brochstein

On September 3rd, 2013 Alan Brochstein, CFA wrote a negative article on Plandai Biotechnology, Plandaí Biotechnology: Avoid This Green Tea Fantasy. Less than a month later he received a letter from Plandai’s outside counsel (Paula Colbath of Loeb & Loeb) accusing him of defaming the company. Ultimately the article stayed up (although behind SeekingAlpha’s paywall) and nothing came of the legal threats.

SPYR Inc (formerly known as Eat at Joe’s)

On August 3rd, 2016 Fuzzy Panda Shorts (follow him on Twitter) wrote on SeekingAlpha about SPYR Inc as a good stock to short and outlined many of the connections with Fiore and Berkshire Capital and many of the penny stocks that Fiore has financed. This is an excellent article that has lots of details on Fiore not easily found elsewhere.

Disclaimer. No position in any stock mentioned and I have no relationship with anyone mentioned in this post. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.