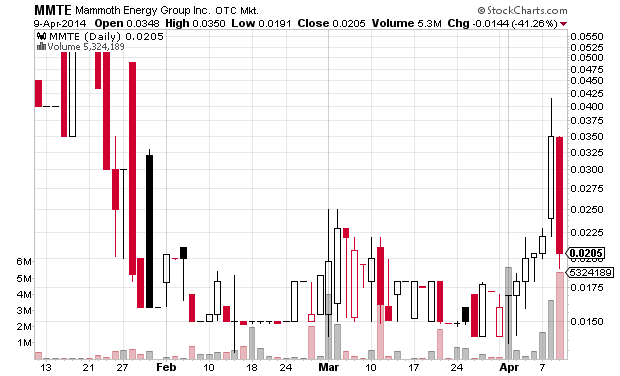

Most of the people trading (and getting rich on paper) off of marijuana stocks are new to the wonderful, wild, and woolly world of OTC stocks. Let me do them a kindness (that they will almost universally ignore) by explaining how pump and dumps work. Most of the companies whose stocks trade on the OTCBB or OTCMarkets are either failing companies or scams. There are some real companies on the OTC but they are few and far between and many of them are just bad companies. Lighting Science (LSCG) and Noble Roman’s (NROM) are a couple great examples — I made big money selling both of them short in 2007 and early 2008. Both are still below the prices at which I covered. And these are some of the better OTC companies.

![]() $78,693profitNROMShort Stock

$78,693profitNROMShort Stock

auto-import all trades old IB account

Posted by MichaelGoode /

http://profit.ly/1MmgQX

![]() $88,401profitLSCGShort Stock

$88,401profitLSCGShort Stock

auto-import all trades old IB account

Posted by MichaelGoode /

http://profit.ly/1MmgQE

It is true that some companies do eventually acquire a real stock market listing after being OTC stocks and some of these companies do well. But these companies are even more rare.

Most of the companies on the OTC — if they are not outright scams / set up for the sole purpose of selling shares in a pump and dump — are marginal companies with inept management with little hope of survival without continuous dilutive financing. Management of these companies are usually dumb or inexperienced. Serious people with serious backing do not reverse-merge their companies into OTC shell companies.

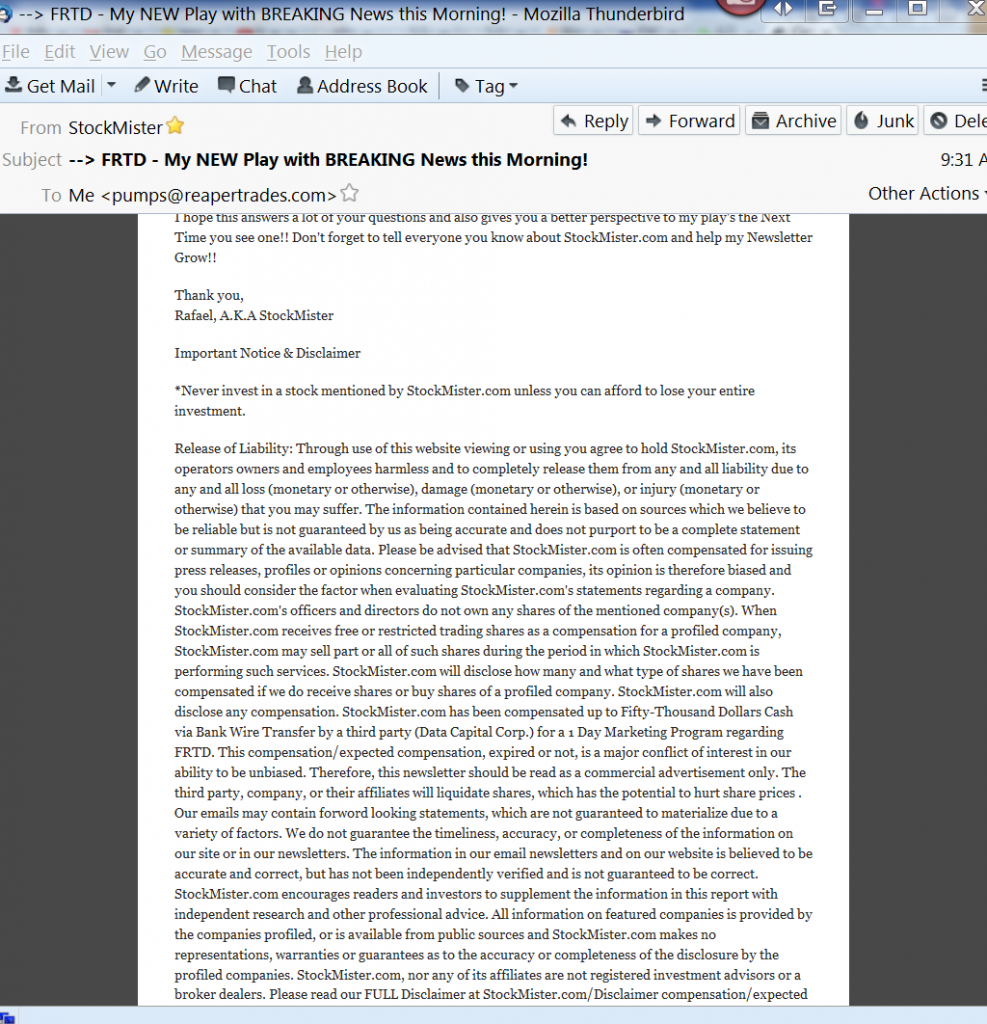

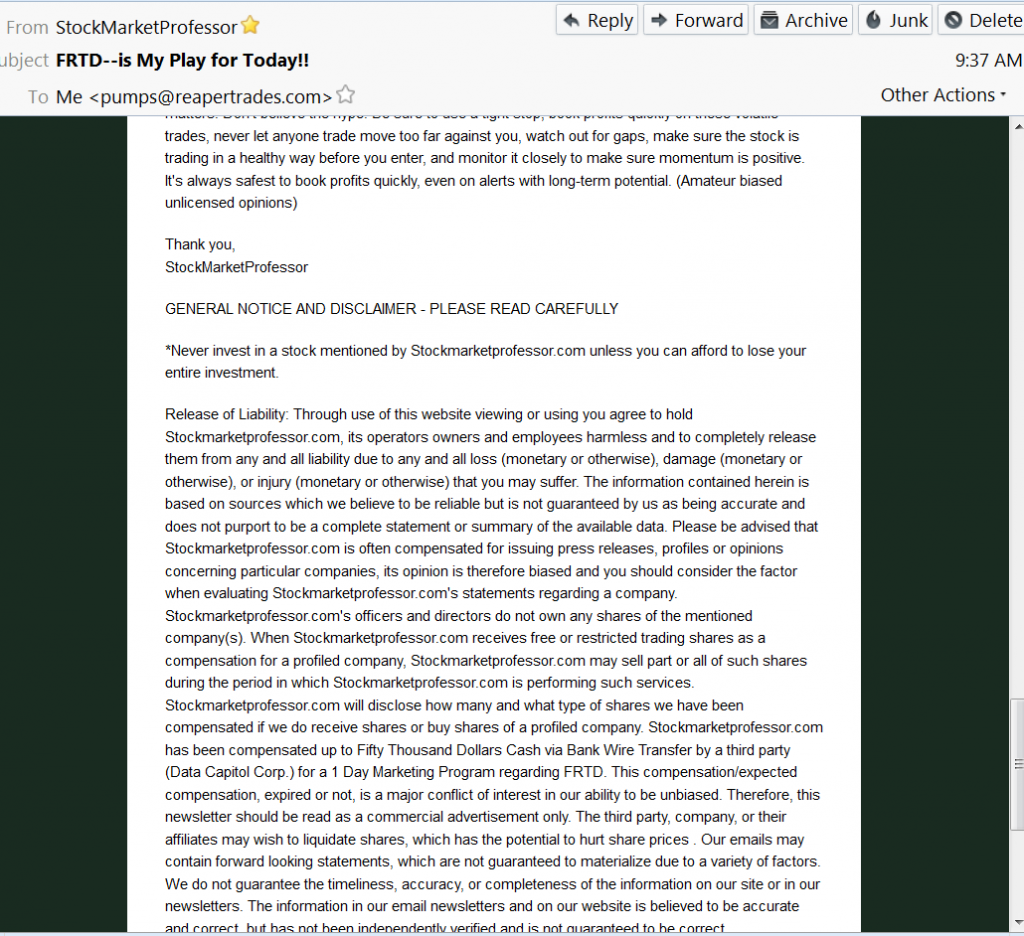

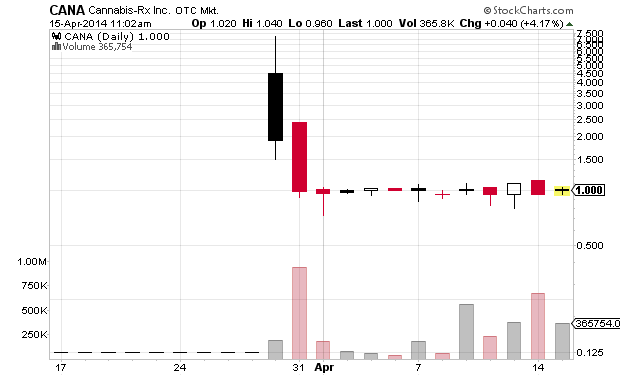

There is one thing I can see that can quickly make me very skeptical of a company’s prospects and that is a paid stock promotion. If someone pays for a stock promotion they are desperate to sell shares — if there were plenty of buyers for their shares they would just sell. Instead, they pay promoters to pump the stock and find buyers so they can dump their shares. A sizable stock promotion is a clear sign that a fairly large shareholder is not bullish on the company and they are in a hurry to sell. So when I received emails yesterday morning from a couple stock promoters promoting Fortitude Group (FRTD) I tweeted that that was a bad sign for investors in the company:

More bad news for the #wolfpack $FRTD now a paid pump & dump — $55k paid to http://t.co/aGv6mm5Uux to pump it today (paid by Data Capital)

— Michael Goode (@goodetrades) April 28, 2014

Of course the #wolfpack didn’t see it that way because their idea of due diligence is to listen to some anonymous guy with no particular experience or understanding other than he had the good idea to buy marijuana-related stocks last autumn and early winter. Some of the OTC-traded marijuana companies may do well but I believe they all will fail. The odds are even worse for those companies that have undergone paid stock promotions, including SKTO, SMVR, NGMC, WBXU, EMBR, PZOO, PLPL, PTOG, XTRM, NVLX, REFG, ICBU, AXXE, PUGE, ERBB, TRTC. And these are only the paid pumps I found in a quick 5-minute search of my inbox.

Below are screenshots of the disclaimers of two of the promotional emails I received this morning on FRTD (click images to see full-size):

I could go into some details on why Fortitude is a bad company and how horribly inadequate their disclosures to OTCMarkets are (the company is not an SEC-reporting company) but I don’t wish to waste any more time trying to convince the marijuana cult members not to drink the hemp Kool-Aid.

Disclaimer: I have no position in any stock mentioned above. I have made money buying and short selling many of the above-mentioned stocks. I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.