On May 15, 2019 the SEC announced a settlement (pdf) with microcap broker Wilson-Davis & Co. for failing to file suspicious activity reports (SARs) about suspicious activity by its clients.

I have written about Wilson-Davis before, most recently in April 2018 about the FINRA OHO Hearing Panel decision against the firm for improper short sales, failures to supervise, and inadequate anti-money-laundering (AML) procedures (currently being appealed; I expect the FINRA National Adjudicatory Council to rule within a few months). Previous, in April 2017 I wrote about a Wilson-Davis settlement with the SEC for Reg SHO violations.

Securities lawyer Laura Anthony described Wilson-Davis in 2016 as one of “only a limited number of clearing brokers” willing to clear penny stocks. Since that time, one of the other clearing brokers mentioned by Anthony, Cor Clearing, agreed in a September 2018 settlement with the SEC to stop accepting the deposit of penny stocks.

Here is the description of Wilson-Davis & Co. from the settlement:

Wilson is a registered broker-dealer located and organized in Utah. It has satellite offices in Colorado, Florida, Arizona, New Jersey, New York, and California. It has been registered with the Commission since 1968, has approximately 7,000-8,000 active customer accounts, and has approximately thirty-two registered representatives. Wilson’s primary business is the liquidation of microcap stocks and is a market-maker in approximately fifty securities.

page 2

There were many failures to file SARs, even in cases where Wilson-Davis closed accounts because of suspicious activity.

9. Although Wilson’s WSPs identify suspicious activity, list red flags, and describe Wilson’s responsibility to file SARs, Wilson failed to adequately conduct AML reviews and to identify, investigate, and report certain suspicious activity related to transactions or patterns of

transactions in its customers’ accounts. Accordingly, Wilson failed to file necessary SARs.

10. Wilson’s primary business involves receiving stock in physical form, selling the position, and wiring out the proceeds from the transaction. Although this pattern is a red flag of potentially suspicious activity according to Wilson’s WSPs, Wilson often failed to investigate or

to file SARs where necessary on these types of transactions.

11. Wilson failed to investigate or file SARs on numerous transactions in which Wilson’s customers exhibited the red flag pattern of depositing a physical certificate, liquidating shortly after the deposit, and wiring the proceeds.

12. In several instances the conduct reached such a level that Wilson froze or even closed the customer accounts. Even when the suspicious activity caused Wilson to close an account, it never filed a SAR.

page 4

The SEC’s descriptions of the details of deposits and sales of stock in three different companies (referred to as Issuers A, B, & C) are mind-blowing. Below are just the red flags associated with Issuer A:

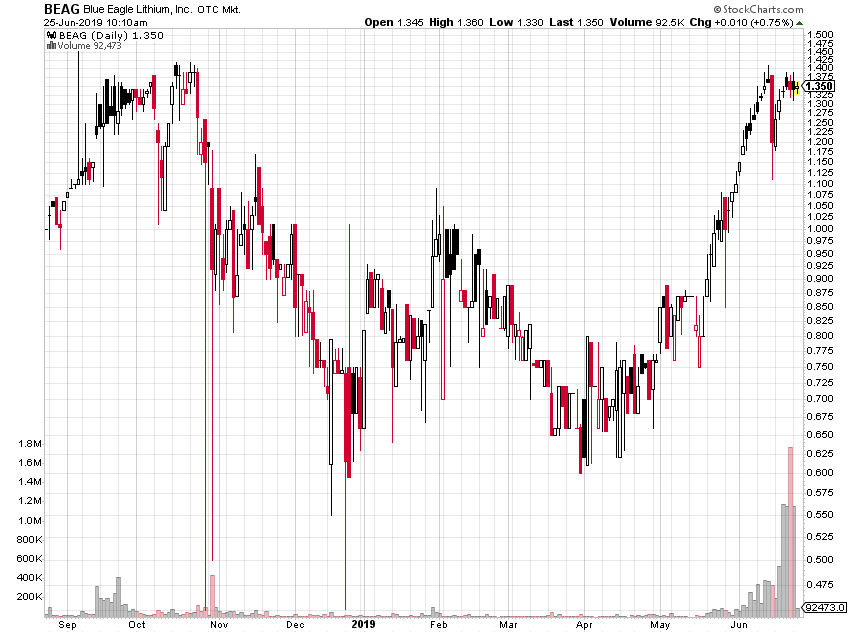

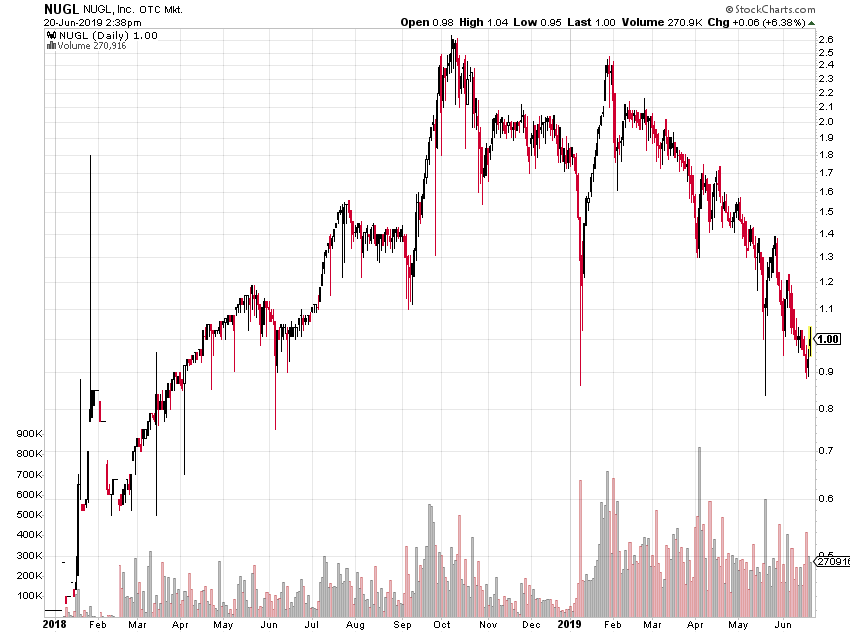

13. From March 2014 to June 2016 (“relevant Issuer A period”), at least fifty-two different Wilson customers deposited approximately 576,540,673 shares of Issuer A. Many of these customers then liquidated 263,641,501 shares during the same period and wired out the proceeds. Issuer A’s CEO also maintained an account at Wilson.

14. During the relevant Issuer A period, the Commission filed an action against a Wilson customer for manipulating several stocks, including Issuer A. The Commission alleged that from January 24 through February 12, 2014, there was an active promotional campaign involving Issuer A. From January 24, 2014 through February 12, 2014, while the suspicious transactions were taking place, Issuer A’s stock price increased by 573%. Although the Commission’s complaint did not allege the manipulative conduct occurred at Wilson, a Wilson registered representative became aware of the Commission action when a customer emailed him an article discussing the SEC action on August 6, 2014. The registered representative notified the Wilson AML officer of the SEC action.

15. In early 2015, Wilson became aware of a news article that said Issuer A’s CEO and others sold shares of Issuer A through Wilson and broker-dealer B. Wilson requested brokerdealer B statements from Issuer A’s CEO and the other Wilson customers accused of selling. Wilson verified that Issuer A’s CEO and others sold Issuer A through broker-dealer B at the same time as selling at Wilson. Wilson immediately froze the accounts for any transactions in Issuer A. Issuer A’s CEO and others had signed a Wilson form at the time of each Issuer A deposit providing that they would not be permitted to sell Issuer A shares at another firm while also selling shares through Wilson.

16. In October 2015 Wilson’s compliance department told a customer it wanted a new attorney to draft opinion letters regarding Issuer A. Wilson had concerns because of the quality of the attorney opinion letters and because of the approximately sixty-seven deposits of Issuer A securities, this attorney authored fifty-eight attorney opinion letters from thirty-four different Wilson customers. Wilson told the customer that Wilson wanted a new attorney with more of an “arm’s length away from the company.”

17. In 2016, the Commission filed an action alleging that Issuer A and Issuer A’s CEO, among others, perpetrated a scheme to evade the antifraud and registration provisions of the federal securities laws. Wilson sent its customer an email saying that due to the SEC complaint, Wilson would not allow sales or deposits of Issuer A securities. Before filing its action, the Commission had sent ten document requests to Wilson regarding approximately ten customer accounts trading Issuer A securities. Wilson eventually determined the conduct to be concerning enough to close all accounts of the individuals named in the Commission’s complaint. Wilson also closed the accounts of family members and several employees of Issuer A.

18. Although many of Wilson customers engaged in transactions of $5,000 or more involving Issuer A that exhibited the red flag activity described above of depositing physical certificates, liquidating the shares, and wiring the proceeds, Wilson never filed a SAR in regard to customer transactions involving in Issuer A. In addition, there were numerous other red flags associated with these transactions. Wilson knew the Commission filed an action alleging manipulation of Issuer A securities. Wilson knew that although several of its customers signed a document saying they would not trade shares at other firms, those customers were liquidating shares at both Wilson and broker-dealer B. Wilson was concerned enough that the same attorney was writing attorney opinion letters to tell a customer he needed to find a different attorney. Finally, Wilson believed the conduct warranted closing numerous customer accounts. Despite all of these red flags, Wilson never filed a SAR on any suspicious trading in Issuer A securities.

pages 4-6

The Punishment

The punishment for all these failures to file SARs seems to me to be really weak: a $300,000 fine and a requirement to hire a consultant and follow the consultant’s recommendations on how to prevent these sorts of failures in the future.

Correction: 2019-7-23: I corrected the date of the settlement. This post originally stated the settlement as being dated 5/15/2018, not 5/15/2019.

Disclaimer: No position in any company mentioned. I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.