The SEC yesterday announced a lawsuit against Scottish trader James Craig for imitating Muddy Waters and Citron Research twitter accounts and in those fake accounts alleging fraud at public companies that caused stock declines. For details, see the SEC complaint (PDF).

The SEC’s complaint alleges that Craig’s first false tweets caused one company’s share price to fall 28 percent before Nasdaq temporarily halted trading. The next day, Craig’s false tweets about a different company caused a 16 percent decline in that company’s share price. On each occasion, Craig bought and sold shares of the target companies in a largely unsuccessful effort to profit from the sharp price swings.

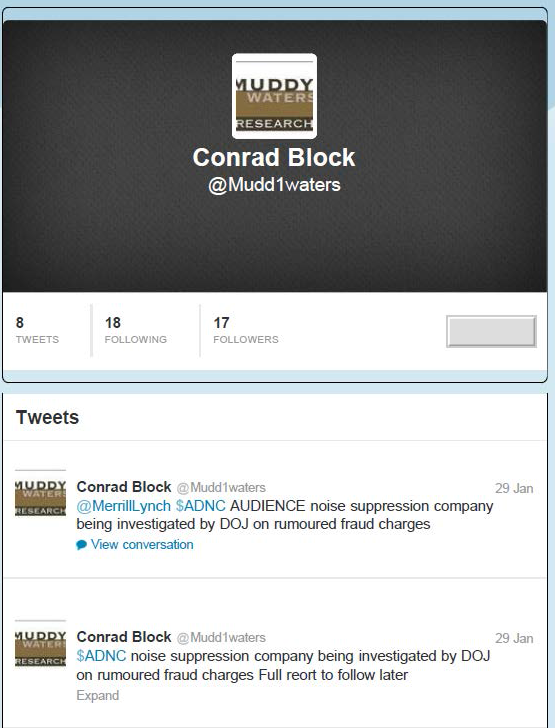

The tweets at the center of the allegations can be seen below:

The Financial Times has a witty take on the absurdity of this case. What is the moral of the story? Don’t try to impersonate people and then use false info to manipulate stocks — it doesn’t matter how little money you make, the SEC will come gunning for you.

Disclaimer: No position in any stock mentioned. I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.