If you follow my Twitter this would not be news, but I have not previously blogged on this subject. For example, I tweeted about The Motley Fool removing a blog post from their website promoting Xumanii (XUII — disclosure: I’m short):

Blog post pumping $XUII quickly taken down by @themotleyfool “Jake Peacock” puts it up at @investingcom http://t.co/7D0vcSYsaN // I’m short

— Michael Goode (@goodetrades) June 10, 2013

Promotion Stock Secrets first wrote about a couple articles that had been commissioned by AwesomePennystocks on stocks they were promoting and about a blog post by a Forbes blogger, Tedra DeSue, promoting Swingplane Ventures (SWVI). Below is the text of her article on SWVI (available online here — the original article was taken down by Forbes).

This Company Has Copper Mining On Its Mind; Stock Moving On News

Demand for copper is falling, but that is not stopping one company from making bold moves to expand its processing of the metal.Trading as a pink sheet stock, Swingplane Ventures Inc. (OTCBB: SWVI) sees there being significant opportunities for copper production on a property it has in Chile. Called the Algarrobo Property, Swingplane says there is considerable potential for production there high grade copper ore.

Company officials admit that production is currently limited because it does not have the proper license needed to sale ore. However, officials say they expect to have the license within a month. Once in production, Swingplane intends to acquire, through rent, lease and/or purchase, the necessary equipment, to increase production.As it pushes to evaluate the potential for copper mining in Chile, the company is also dealing with concerns about its stock. Last week, it issued a note for investors saying it was aware of the volatility in the trading volume and price of its stock. Company officials are taking issue with a lot of chatter on Internet blogs and chat rooms that they say is not accurate.

In a statement released last week, it said its officers and directors are not “aware of any activity by stockholders or investor relations activity that may be the cause of this recent volume and price increase.” Specifically, the price reached almost $1 a share after trading at just under $.20 a share.

One of the world’s most recognized consulting firms in the mining industry has been contracted to assess the Algarrobo property.

At least one company is giving Swingplane good reviews. Awesome Penny Stocks notes that Swingplane is working with AMEC (AMEC International Ingenieria y Construccion Limitada) for an initial evaluation and report on the property in Chile. The consulting firm has been ranked two years in a row as a sector leader, which should bode well for Swingplane as it moves forward on its crucial mining effort. Amec is known for its work with companies like BP, Shell and the U.S. Navy.

As the company assures investors that its finances are strong, it must also deal with the fall in copper prices. The Wall Street Journal reported that the metal fell 5.4% this week, which was its work week since December 2011. The fall is due to China, the biggest buyer of copper, not buying as much of the metal.

I think that demand for the medal will pick up as the global economy recovers. As it does, the steps Swingplane is taking with its mining efforts in Chile will make it well-positioned as a company and a stock.

Not everyone has to stomach for over the counter stocks. If you do, you’re encouraged to take a hard look at this one. Some ideas include shorting the stock. As one investor said, to make money on the upside, get in early and get out early. You may be surprised that and happy about anything you make in between.This article was distributed through the NewsCred Smartwire.

By Tedra DeSue for Forbes

Original article © Forbes

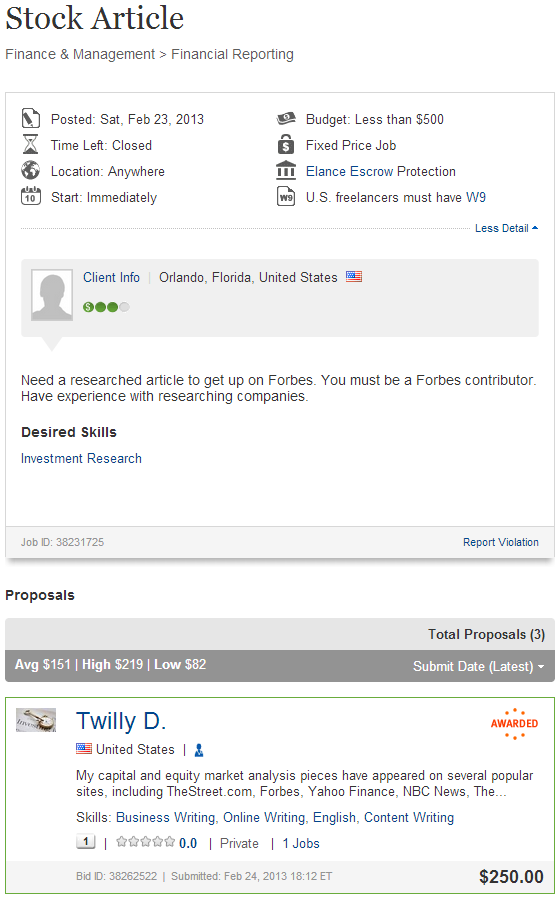

As was pointed out by someone (but I can’t remember who, because I think it was in tweets that were deleted), Tedra Desue has a website that links to a profile on eLance. Interestingly, there was a job posted on eLance that was for a Forbes article or blog post that she was hired for one day before she posted the positive blog post on SWVI. I am nearly certain that that job was for writing a pump article on SWVI (but it is possible though unlikely that this is just a coincidence). She was paid $250 for the article requested by that job. Unfortunately the person or entity that paid for the article deleted their account so it is not possible to see what other jobs they paid for. Below is a screenshot of the job.

Back in May The Motley Fool had a good article on how their site had been used to promote stocks by authors who did not disclose that they were paid to write positively about certain stocks. That article was reviewed in an article in the Columbia Journalism Review. That article was followed by Seeking Alpha’s mea culpa on their site being used to promote Goff Corp (GOFFE).

SeekingAlpha has indicated that they will change their procedures somewhat to reduce the possibility of stock promoters publishing articles on their platform:

How We Are Addressing Our Failure

First, we have conducted a review of the authors that posted these articles and for a variety of reasons in addition to this event, they will no longer be contributing to Seeking Alpha. It bears noting that we have no evidence that any of them were complicit in any illicit activity.Second, we have reviewed our editorial processes and, as noted above, found them lacking. Therefore, we will be updating them as follows: First, in order to be included in an article, a stock will have to be trading at $1 or more per share AND have a minimum market cap of $100 million. If an article focuses on a single stock, we may make an exception in cases where we believe there is extreme value to our readers, and where the article provides deep, balanced research. While we recognize that a “one-size-fits-all” rule will inevitably impact our legitimate authors, our concerns over illegitimate stock promotions are such that we have to err on the side of caution.

But we will not stop there. In order to prevent inappropriate stocks being covered and potentially manipulated, when we receive an article on a stock that doesn’t meet the $1/$100 million threshold, we will conduct a secondary review to see if it is part of a paid promotion. You’ll forgive me for not sharing the precise review process in a public forum, but suffice it to say it will be robust. When questionable stocks are identified, submitting authors will be dealt with firmly.

Just two days ago, all these events were reviewed in an article for TheDeal.com by associate editor Bill Meagher. Below is an excerpt, including a couple quotes from me:

Jacob Wolinsky, who runs investment information website ValueWalk, said he was offered $1,000 to write an article praising Sunpeaks. Wolinsky said he was offered an additional $500 if he agreed not to disclose the payment, but refused the bonus. The article was published on Seeking Alpha in April 2012.

“I thought the guy who I talked to was just a shareholder who wanted some positive P.R.,” Wolinsky said in an interview. “I had no idea that there was a promotion going on. It was the first and the last time I did a sponsored story.”

Michael Goode, who has published almost 50 articles on Seeking Alpha, called Wolinsky’s article “yet another paid stock promotion on Seeking Alpha,” in a comment on the site. “SA has gone completely to the dogs over the last few years. It is a shame.”

Goode, a frequent investor and short seller in microcap stocks, said part of the problem with Seeking Alpha is there are so many contributors doing so many stories. “They let a lot of stuff go, and there is only so much they can do,” he said. “They are a lot better than they used to be.”

I do apologize for my contradictory remarks. I do think that SeekingAlpha has improved its editorial overview over the last few years but stock promoters and manipulators have been even better at evading the editors.

With SeekingAlpha, The Motley Fool, and Forbes becoming more vigilant the pumpers will likely go other places. With the current Awesomepennystocks.com pump Xumanii (XUII) I have seen them link to two positive articles on Investing.com that disclose no compensation but, knowing what I know now, I am almost certain that those authors were compensated.

Disclaimer: I am short 13,875 shares of XUII and have no position in any other stock mentioned above. I have no relationship with any parties mentioned above except that I talked to Meagher and am a contributor to SeekingAlpha. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.