Colin McCabe, publisher of Elite Stock Report, The Stock Profiteer, and Resource Stock Advisor, was just sued today by the SEC. McCabe has previously drawn the ire of Chuck Jaffe of MarketWatch. The essence of the SEC’s complaints are that McCabe promoted stocks to his paying subscribers without disclosing his compensation, he lied about the research that went into his picks, and he lied about one particular pump, GNXP (Guinness Exploration). The main allegations against McCabe are fairly standard — failing to disclose compensation and blatant lying. What I find more interesting is that the SEC spends a decent portion of the complaint alleging McCabe’s misrepresentation of his service. If the SEC can win on those allegations then I would expect them to become more aggressive in pursuing other promoters who use aliases or lie about the research they put into stock promotions.

From the litigation release:

In its complaint, the Commission alleges that, from at least early 2008 through 2011, McCabe, among other things: made false and misleading claims about how he selected recommended stocks; failed to disclose to his newsletter subscribers that he was being paid substantial sums to recommend some of the same stocks in his other publications; and made false and misleading statements about the assets of one of the issuers he recommended.

Here are the allegations of lying about his research process and other details of his picks (from the complaint, emphasis mine):

19. Beginning in 2006, when McCabe began publishing Elite Stock Report, and in 2009, when McCabe began publishing The Stock Profiteer and Resource Stock Advisor, McCabe falsely claimed that his Elite Stock Report, The Stock Profiteer and Resource Stock Advisor publications were the result of extensive research conducted by researchers with relevant expertise and contacts. In fact, McCabe’s research was limited to reviewing issuer filings with the Commission, press releases, and the issuer website. He did not have any assistance in researching stocks or writing his publications. These false and misleading statements are believed to have continued through 2011, when McCabe claims to have ceased publishing Elite Stock Report, The Stock Profiteer and Resource Stock Advisor.

20. In the January 2009 issue of Elite Stock Report, McCabe falsely claimed that “[w]e research every company intensely and no company gets the go ahead unless they pass the ‘Profit-Potential Checklist.’ One of the must-haves on that list is a high probability of big, juicy returns. Triple-digits minimum.” Clearly, there was no “we” since McCabe alone did the research. Also, McCabe did not utilize “Profit-Potential Checklist” to assess the probability of such extraordinary returns.

21. Elite Stock Report’s website also falsely claimed that McCabe identified his recommendations “[t]hrough his network of global connections” and claimed that “his contacts extend deep into the world’s hottest resource investment zones — particularly Asia, Europe, and of course, North America — resulting in a wealth of knowledge and opportunity for his readers.” In fact, McCabe’s recommendations were not acquired or informed by a network of global connections, and were instead the result of McCabe’s review of public filings and issuer websites.

22. When Elite Stock Report moved to an online-only format for subscribers beginning with the January 2009 issue, it claimed that the change meant that “we can provide you with . . . more in-depth analysis [and] additional ground breaking research . . . of the companies we follow.” However, McCabe did not conduct any such “ground breaking research” or “in-depth analysis” prior to making stock recommendations.

23. Similarly, McCabe falsely represented on The Stock Profiteer website that a “research team” made the stock recommendations in The Stock Profiteer. McCabe claimed that “[o]ur research team has hundreds of information sources and contacts, and years of experience in the analysis of small stocks.” In fact, there was no research team, McCabe made stock recommendations himself, and he had no special expertise or network of contacts.

24. McCabe claimed on The Stock Profiteer website that his researchers applied “a scientific (and proven) selection methodology to small stocks…” In the first issue of The Stock Profiteer, McCabe falsely represented that recommended stocks were identified by “my time-tested, proprietary investing methodology.” Subsequent issues also referenced McCabe’s proprietary research and “proprietary system” for selecting stocks. However, there was no “proprietary” system or scientific methodology.

25. McCabe also misled readers about who prepared The Stock Profiteer publications. When McCabe began publishing The Stock Profiteer in 2009, he sent an alert to Elite Stock Report subscribers which read: “My good friend Joe Marino is launching his brand new publication The Stock Profiteer tomorrow, and he was kind enough to make you a very special offer because you’re a loyal Elite Stock Report subscriber…Joe will be releasing his first blockbuster pick tomorrow and from what he’s told me, it’s a sure-fire grandslam.” The Stock Profiteer publications consistently stated that Joe Marino was the editor. However, Joe Marino never existed and is an alias used by McCabe to disguise his responsibility for The Stock Profiteer.

26. McCabe made similar false statements with respect to Resource Stock Advisor in various publications disseminated between 2009 and 2011. Under the heading “Who is Roger Gaines?” Resource Stock Advisor’s website claimed that he is “[a] highly-trained economist who can spot trends before they happen, Roger Gaines spent most of the last decade either working ‘in the trenches’ of Wall Street or traveling the globe in search of the world’s best resource investment opportunities.” However, Roger Gaines never existed and is simply another alias used by McCabe. McCabe has no experience “working ‘in the trenches’ of Wall Street” and, in fact, he was writing his stock promoting newsletters from his home in British Columbia

Similarly, McCabe did not travel the world in search of resource companies to recommend to his readers.

27. McCabe knowingly or recklessly made the above misleading statements and omissions regarding his purported research process, publications, and stock recommendations. These misleading statements and omissions were material since subscribers and investors considered the information provided by McCabe when deciding whether to buy his recommended stocks and they would have been less likely to buy the stocks he recommended if they had known the true facts.

Here are the allegations of failing to disclose his compensation to his paying subscribers (from the complaint):

28. As described above, McCabe told his subscribers that his stock picks were the result of extensive research, experience, and contacts. In fact, McCabe was being paid more than $16 million to promote some of these stocks. However, McCabe did not disclose his receipt of this compensation to his subscribers even though he was being compensated during the same timeframe that he recommended the stocks to them.

Here are the allegations of lying about GNXP (from the complaint):

33. In February 2010, McCabe distributed a paid mass mailing to non-subscribers as an Elite Stock Report “Special Report” titled “My latest junior gold pick will hand my subscribers Monster-gains inside the next 60 days…and could go 10-for-1 in the next 12 months.” The recommended stock was Guinness, and McCabe distributed a virtually identical report multiple times over the next several months. Case 2:13-cv-00161-BCW Document 2 Filed 03/05/13 Page 9 of 12

34. In those reports, and in concurrent Elite Stock Report subscriber publications, McCabe falsely represented that Guinness had acquired an 8,000 acre property in the middle of the Tintina Gold Belt in the Yukon Territory of Canada well before discoveries in May 2009 turned the region into “a red-hot area play.” McCabe also claimed that the property held “an estimated recoverable resource in excess of 1 million ounces of gold.”

35. In fact, Guinness had not purchased the relevant property until November 2009 – well after the May 2009 discoveries that McCabe claimed increased the value of the property. Thus, McCabe’s statements about the fortunate timing of Guinness’ property acquisition were false and misleading. Moreover, Guinness never claimed that its property held “an estimated recoverable resource in excess of 1 million ounces of gold,” and McCabe’s representations in this regard were false and misleading.

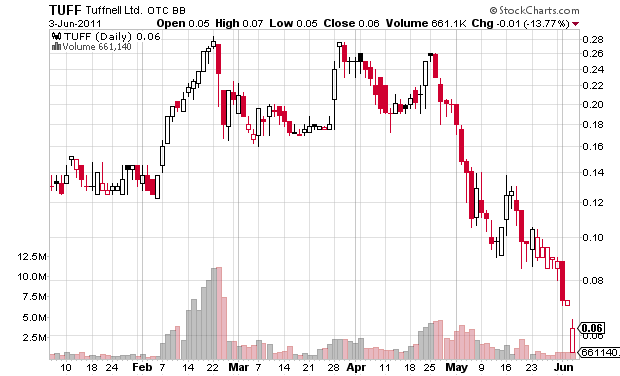

The most recent promotion that I saw McCabe do was of Tuffnell (TUFF) just under two years ago. People reported receiving hard mailers for TUFF around March 30th, 2011. TUFF most recently traded at $0.0051, over 98% down from its highs during the promotion. Here is the stock chart from that time period:

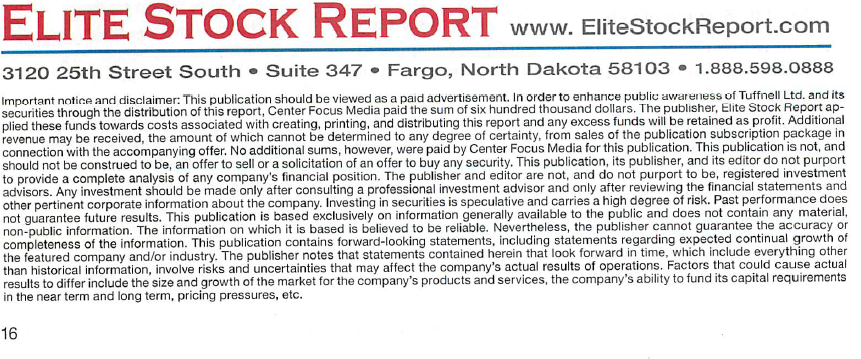

Below are scans from the mailer, courtesy of Peter Michaelson:

(click images to see full size)

[Edit 2014-7-21]: The British Columbia Securities Commission found that Colin McCabe made misrepresentations and acted contrary to the public interest. They have not announced penalties against him yet.

Press release:

2014/55

July 15, 2014Vancouver – A British Columbia Securities Commission panel has found that a tout sheet publisher made misrepresentations and other misleading statements when promoting three companies traded on the Over-the-Counter-Bulletin-Board (OTCBB) in the United States. The panel also found that the managing director of a Swiss company facilitated secret payments to the tout sheet publisher in connection with one of the promotions

The panel found that between October 2009 and July 2010, Colin Robert Hugh McCabe, of Abbotsford, B.C., featured three OTCBB-listed companies in his Elite Stock Report tout sheet. The panel said that McCabe “wrote and published grossly misleading reports while acting on retainer from third parties without knowing, or even inquiring, as to the parties’ interest in the promotion, or its purpose.” The panel also found that McCabe “facilitated clandestine payment arrangements.”

The panel found that McCabe engaged in egregious conduct contrary to the public interest. The panel said, “In our opinion those who ultimately profited through these promotions, or hoped to do so, could have done so only by improper market conduct, which would reasonably call into question the confidence that should be placed on our capital markets if this sort of conduct were tolerated.”

McCabe was asked to promote one of the companies by Erwin Thomas Speckert, the managing director of a Swiss company called Everest Asset Management. The panel found that Speckert acted as an intermediary for unknown persons and arranged secret payments to McCabe.

The panel found that Speckert engaged in conduct contrary to the public interest. Speckert “had to have known that the purpose of these arrangements was to conceal the relationship between the unknown persons and McCabe,” the panel said. “Speckert’s facilitation of secret payments to McCabe made him an active participant in the process and was an essential part of the promotion.”

The panel directed the parties to make submissions on sanctions according to the schedule set out in the findings.

You may view the findings decision on our website www.bcsc.bc.ca by typing Colin Robert Hugh McCabe, Erwin Thomas Speckert, or 2014 BCSECCOM 269 in the search box. Information regarding disciplinary proceedings can be found in the Enforcement section of the BCSC website.

Please visit the Canadian Securities Administrators’ Disciplined Persons List for information relating to persons disciplined by provincial securities regulators, the Investment Industry Regulatory Organization of Canada (IIROC) and the Mutual Fund Dealers Association (MFDA).

Article in The Globe and Mail.

See the full findings (PDF) of the Commission.

Disclaimer: I have no position in any stock mentioned above and no connections with any people mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.