See the SEC litigation release here and the legal complaint (PDF).

SECURITIES AND EXCHANGE COMMISSION, Plaintiff, v.

RECYCLE TECH, INC., KEVIN SEPE, RONNY J. HALPERIN, RYAN, GONZALEZ, OTC SOLUTIONS LLC, ANTHONY THOMPSON, PUDONG LLC, JAY FUNG, and DAVID REES,

Of the two stocks mentioned in the SEC legal complaint, Recyle Tech (RCYT) is the more interesting pump. I made money buying and shorting it when it was pumped back in February of 2010. It was pumped by Pennypic.com (owned at the time by Pudong LLC, which is owned by Jay Fung), Explicitpicks.com, and OxofWallstreet.com (owned at the time by OTC Solutions Inc., which was allegedly owned by Anthony Thompson at the time). All these websites are listed in the complaint but at least one other website associated with OTC Solutions Inc. (FreeInvestmentReport.com) was not listed in the complaint (while the pump emails did not mention OTC Solutions Inc. they all shared identical disclaimers).

4. OTC Solutions and Pudong, and their respective owners, Defendants Anthony Thompson and Jay Fung, actively participated in the scheme through their promotion of Recycle Tech stock. In January and February 2010, OTC Solutions and Pudong, both stock promotion companies, collectively issued five e-mail newsletters touting Recycle Tech. Thompson and Fung each received more than two million shares of Recycle Tech stock as compensation for their touting efforts. Their newsletters, however, did not adequately disclose their stock compensation or Thomson and Fung’s stock sales.

Also involved in the RCYT promotion, disclosing 2,475,000 shares in compensation but not mentioned in the complaint, were the following websites: StockPickTrading.com, TitanStocks.com, and Monsterstox.com, which months later started disclosing ownership by Golden Dragon Media Inc. (there is a Nevada corporation with Eric Van Nguyen as the sole officer that was dissolved on 16 April 2010; a company with the same name and also with Nguyen as the sole officer was formed in Quebec on 29 September 2009 and has a registration number or NEQ of 1166132507; its name was originally 7247257 Canada Inc. and was changed to Golden Dragon Media on 26 April 2010). I cannot verify what entity owned those websites in February 2010.

Furthermore, the following two websites promoted RCYT while not disclosing any compensation: PennyStockAdvice.com (disclaimer) and PennyStocksExpert.com (disclaimer). These websites have been involved in recent big stock promotions such as NSRS and SNPK. I have submitted evidence of these others promoters of RCYT to the SEC; it is possible that the SEC lawyers were aware of these other promoters but investigated them and found that they did not violate the law.

The charges against the stock promoters are familiar to those who follow these sorts of cases: scalping and inadequate disclosures. Here are the charges against OTC Solutions Inc:

12. OTC Solutions is a Maryland limited liability company formed by Thompson in 2007 as a marketing and advertising company. From no later than January through March 2010, it was associated with “Explicit Picks” and “Ox of Wall Street,” both stock promotional newsletters.

13. Thompson, age 35, is a resident of Bethesda, Maryland. From no later than January through March 2010, he was the sole member of OTC Solutions.

…

G. OTC Solutions and Pudong Tout Recycle Tech Stock without Properly Disclosing Their Stock Compensation or Intent to Sell

65. Four days after the February 18 press release, OTC Solutions and Pudong started touting Recycle Tech stock in their newsletters. Thompson and Fung, the respective owners of OTC Solutions and Pudong, had previously agreed to coordinate their touting with each other and with Sepe.

66. Before they issued their newsletters, Sepe agreed to provide Thompson and Fung with 2.325 million shares each of Recycle Tech stock. Halperin provided the actual shares to Thompson and Fung.

67. On February 22, 23, and 24, 2010, OTC Solutions and Pudong collectively issued at least five newsletters promoting Recycle Tech. Many of the newsletters reprinted portions of Recycle Tech’s false and misleading press releases, which Sepe had provided to Thompson and Fung.

68. Each newsletter included its own language hyping the stock. For instance, the various newsletters touted Recycle Tech as: a “golden opportunity;” “the type of GEM you want to research on before Wall Street gets a hold of it;” “a huge bargain that could be gone very soon!” and the Next EXPLOSIVE Stock.” None of the newsletters disclosed the newsletter owner’s intent to sell shares, or named the source of the stock the newsletter had received.

…

1. OTC Solutions’ Recycle Tech Touting and Scalping

69. Between February 22 and February 25, 2010, Thompson, through OTC Solutions, engaged in the fraudulent practice of “scalping,” specifically, selling the same stock his own reports on Recycle Tech were recommending that investors buy without disclosing the sales.

70. After receiving its 2.325 million shares, OTC Solutions issued at least four newsletters touting Recycle Tech. Specifically, on February 22, 2010 and February 24, 2010, -15- OTC Solutions touted Recycle Tech in two issues of “Explicit Picks” and two issues of “Ox of Wall Street.”

71. Also on February 22, 2010, OTC Solutions started selling its Recycle Tech shares. It sold all 2.325 million shares by February 25. These sales contradicted the recommendations OTC Solutions made regarding Recycle Tech.

72. None of OTC Solutions’ newsletters disclosed the stock compensation it received from Sepe for the promotional campaign, its ownership of Recycle Tech stock, or its stock sales. Instead, the four newsletters contained a brief disclaimer section regarding penny stocks in general and OTC Solutions’ registration status.

Here is the disclaimer from the Pennypic.com pump emails sent on February 23, 2010:

Pennypic has received from a third party non affiliate 2.325 million free trading shares of recycle technologies inc for advertising and marketing

The SEC legal complaint acknowledges the disclosure as correct but alleges that Jay Fung, who at the time owned Pennypic.com through his company Pudong LLC, scalped the shares by selling all his shares on the first day of the pump.

14. Pudong is a Florida limited liability company with its principal place of business in Delray Beach, Florida. From no later than January through March 2010, it was a marketing and advertising company associated with “Penny Pic,” a stock promotional newsletter.

15. Fung, age 37, is a resident of Delray Beach, Florida. From at least January through March 2010, he was the sole member of Pudong.

…

2. Pudong’s Recycle Tech Touting

73. On February 23, 2010, Fung, through Pudong, also engaged in the fraudulent practice of scalping.

74. On February 23, after receiving its 2.325 million shares of Recycle Tech stock, Fung’s company, Pudong, issued at least one “Penny Pic” newsletter touting Recycle Tech. On the same day, Pudong sold all 2.325 million of its Recycle Tech shares. This sale contradicted the recommendations Pudong made regarding Recycle Tech.

75. Moreover, the newsletter only contained a general disclaimer. The newsletter disclosed: [w]hen Pennypic.com receives free trading shares as compensation for a profiled company, Pennypic.com may sell part or all of any such shares during the period in which Pennypic.com is performing such services.” It then specifically disclosed that it “has received from a third party non affiliate 2.325 million free trading shares of [Recycle Tech] for advertising and marketing.

76. The newsletter did not, however, disclose the third party’s identity or Fung’s Recycle Tech stock sales.

…

84. On February 23, 2010, Pudong sold 2,325,000 shares for $456,457.

The SEC has consistently held that the practice of scalping (a promoter or trading service selling their own shares directly into their paid promotion or buy alert) is illegal. It has consistently argued that a general disclaimer saying something to the effect of “we may sell our shares at any time” is insufficient. The SEC has consistently won settlements with stock promoters and traders who have engaged in the practice. More interesting to me is line 76: I have not seen the SEC previously assert that failing to disclose the identity of the party that pays for the stock promotion is illegal. I do hope that this marks the beginning of the SEC getting more aggressive in suing those who commit what may seem to be smaller, technical violations.

Following are the details of the pump campaign’s affects on the stock:

H. Promotional Campaign Falsely Inflates the Market for Recycle Tech Shares

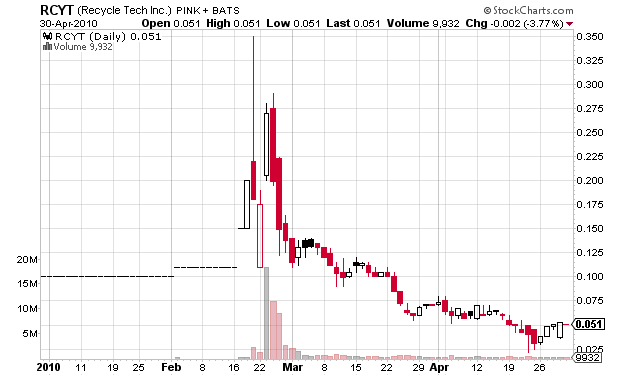

77. In the three-month period preceding the promotional campaign, Recycle Tech had experienced only four days of any reported trading of its stock.

78. The stock price remained consistently at ten cents per share from December 10, 2009 to February 1, 2010. From February 2, 2010 to February 16, 2010, the price of Recycle Tech stock stood at eleven cents per share.

79. From February 3 through 16, 2010, no shares of Recycle Tech were traded. On February 18, 2010, the day Recycle Tech issued its first press release, the company’s trading volume jumped to 35,000 shares from 6,000 the previous day. The day after the company issued its first press release, the stock volume soared to over more than 2,000,000 shares.

80. Over the next several days, with the addition of OTC Solutions and Pudong’s newsletters, the stock volume increased to more than 18 million shares traded, with an intraday high of 28 cents per share.

And here is a pretty chart:

Through March 1, 2012, emails from Pennypic.com disclosed the owner as Pudong LLC. It appears that the domain has been sold since then.

This is a really interesting lawsuit by the SEC and I cannot do it justice in this one blog post. Expect a follow-up post in the next day or two with details on how the insiders of the pumped companies allegedly put the companies together, issued false press releases, and used incorrect legal opinions to sell stock that was not registered.

Disclaimer: I have no positions in any stocks mentioned and no relationship with any people mentioned. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.

Wow, looks like he panicked and sold all of his shares in one day instead of holding and slowly letting them go. Either he was greedy and didn’t want to miss the spike, or just an idiot and din’t realize it would seem odd that he sold all of his shares in one day.

Not sure the outcome would’ve been any different for him; if he would have sold slowly I wonder if he would have gotten caught.

It seems i remember talking about this stock on the Reaper (may it rest in peace) site back in the day.

I will probably end up clarifying what I said above about scalping. It is important to note that the illegal practice of scalping is completely different from what I or other traders mean when we talk about scalping. In our (legal) scalping, we just buy and sell rapidly for quick, small gains. This can be for no reason at all or after some trader or promoter or news event makes a stock move. There is nothing wrong with this. Illegal scalping is when someone who engages in trading or trade alerting or promoting as a business tells other people to buy and then sells into their buying.

That was a terrible promo. These guys could learn from APS. Now they know how to run a great promo.

It is funny you say that; Awesomepennystocks actually pumped RCYT at the same time. Their promotions rarely did well for more than a couple days prior to POTG in 2011.